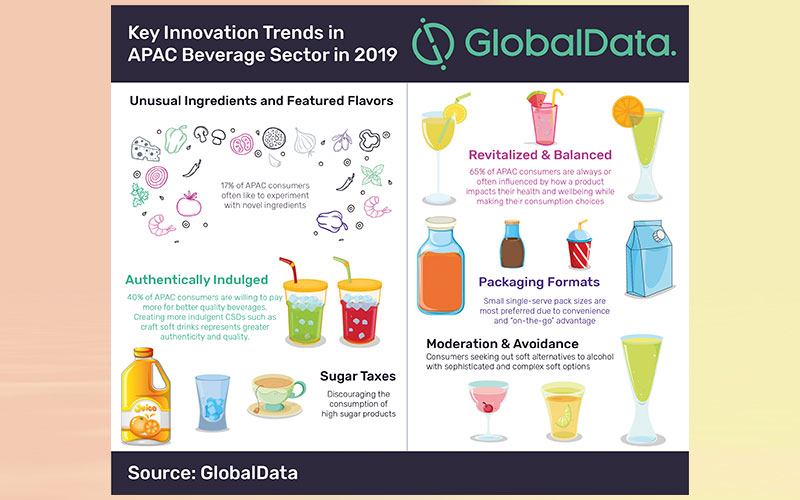

Key innovation trends in beverage sector to watch out for in APAC in 2019, according to GlobalData

The beverage sector has undergone a significant transformation over the past decade in line with changing consumer preferences.

The beverage sector has undergone a significant transformation over the past decade in line with changing consumer preferences.

Sumit Chopra, Consumer Research Director at GlobalData, a leading data and analytics company, highlights six major innovation trends that are set to impact the production, marketing and sales of the beverage sector in Asia-Pacific (APAC) in 2019.

Unusual ingredients and featured flavors

GlobalData’s 2018 Q4 Consumer Survey found that 17 % of consumers in APAC often like to experiment with novel ingredients, creating opportunities for manufacturers. For instance, India-based urban lifestyle beverage brand Zago launched Iced Masala Chai, which offers a ‘refreshing’ twist to traditional ready to drink teas infused with traditional aromatic flavors such as cardamom and ginger.

Authentically indulged

According to GlobalData’s 2018 Q4 Consumer Survey, around 40 % of APAC consumers are willing to pay more for better quality beverages. Against this backdrop, beverage manufacturers are aiming to create an authentic brand image to foster consumer trust and loyalty. In Australia, Podpac is offering new coffee pods under the Baileys trademark in order to give coffee drinkers a premium indulgence that is marketed under an alcohol brand name.

Revitalized & balanced

GlobalData’s 2018 Q4 Consumer Survey highlights that 65 % of consumers in APAC are always or often influenced by how a product impacts their health and wellbeing while making their consumption choices. Against this backdrop, beverage companies are mapping out the wellness considerations for the products they are offering to attract a niche market of specialists such as sports enthusiast and athletes, whilst also appealing to the mainstream of active lifestylers. For example, Applelachia launched a sparkling apple cider drinks range that incorporates foreign ingredients like Yuzu, a citrus fruit used as a tonic by samurais to boost their immune system, in Australia.

Packaging formats

GlobalData’s research reveals that APAC consumers prefer small single-serve pack sizes and seek out new products packed in PET and small metal cans, reflecting the overall emerging trend in the region towards on-the-go consumption. For instance, Locally Merci Buco 100 % organic coconut water in a 330 ml tetra pack variant bagged a packaging excellence award for an innovative PET squeezable bottle in 2019 in the Philippines, as it catered to the strong association between energy drinks and on-the-go consumption.

Sugar war raging

Beverage companies need to be ready for the likelihood of stringent regulations, as the governments across the region are exercising more power, particularly around issues such as obesity and consumer welfare. Malaysia’s Ministry of Health is all set to impose a sugar tax on sugar-sweetened beverages from 1 July 2019. Against this backdrop, key beverage brands are reformulating their portfolios. For instance, Malaysia-based Fraser & Neave (F&N) Holdings Bhd is looking to reformulate 70 % of its products to mitigate the sugar tax impact.

Moderation & avoidance

Consumers are increasingly becoming health-conscious and proactively addressing their health issues by curbing alcohol indulgence. Manufacturers are therefore striving towards offering zero alcohol beverages with healthy ingredients. Heineken’s launch of new zero-alcohol beer Heineken 0.0 in Singapore fulfills the growing demand for non-alcoholic alternatives for evolving customers.