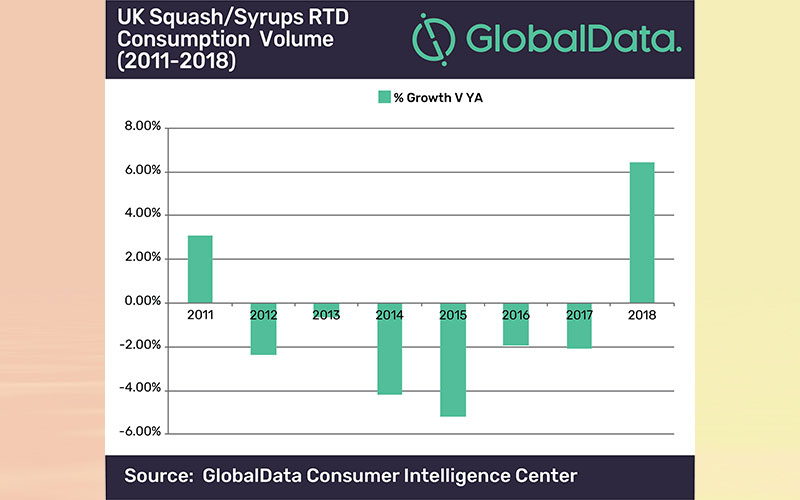

UK Squash saw 6 % increase in consumption in 2018, after years of plummeting sales

GlobalData’s Q4-2018 Quarterly Beverage Forecast reported a remarkable 6 % volume increase in consumption for UK Squash and Syrups in 2018*, the first time the category has seen growth since 2011.

GlobalData’s Q4-2018 Quarterly Beverage Forecast reported a remarkable 6 % volume increase in consumption for UK Squash and Syrups in 2018*, the first time the category has seen growth since 2011.

Roisin Vulcheva, UK & Ireland Research Manager for Consumer at GlobalData, says, “This was an impressive result, particularly as Squash and Syrups have experienced several years of consecutive decline. The strong performance was driven by an array of factors including good weather, growth in adult soft drinks and new product development. Throughout 2018, there was a raft of premium launches helping Squash and Syrups to stage a turnaround and inject value growth back into the category.”

Throughout the year, growth was positive across all quarters, however summer was the key period of trading for the category, with the UK recording one of the hottest summers on record which helped to boost consumption.

Britvic was also instrumental in driving growth throughout the year. It invested heavily in Squash and Syrups, expanding its offering to appeal to a more mature demographic, in what is typically a category largely geared towards children. Britvic launched several new products targeted towards the adult segment under its Robinsons brand in 2018.

Interestingly, still ready-to-drink drinks, which include brands such as Capri Sun and Robinsons Fruit Shoot that also cater to the children’s demographic, declined by 10 % in volume terms for the year*, largely impacted by concerns around sugar and artificial sweeteners.

Vulcheva concludes, “Clearly the introduction of new flavours, packaging and more premium propositions helped to drive growth in the category which was further boosted by a hot summer. Looking ahead to 2019, the Squash and Syrups category is one to watch as it ticks the box in relation to several current key trends in the UK soft drinks market. More innovation is expected from branded players throughout 2019, with private label brands expected to emulate the efforts of branded players.”

*UK Quarterly Beverage Forecast Q4-18