Fortified drinks with health-enhancing ingredients next big opportunity in APAC, says GlobalData

As the economic outlook for Asia-Pacific (APAC) remains strong and consumers in the region continue to put in a high level of performance, stress and overwork will be the important concerns related to mental health among them.

As the economic outlook for Asia-Pacific (APAC) remains strong and consumers in the region continue to put in a high level of performance, stress and overwork will be the important concerns related to mental health among them. Against this backdrop, beverage makers which offer fortified drinks with health-enhancing ingredients will have an edge over others in the region, says GlobalData, a leading data and analytics company.

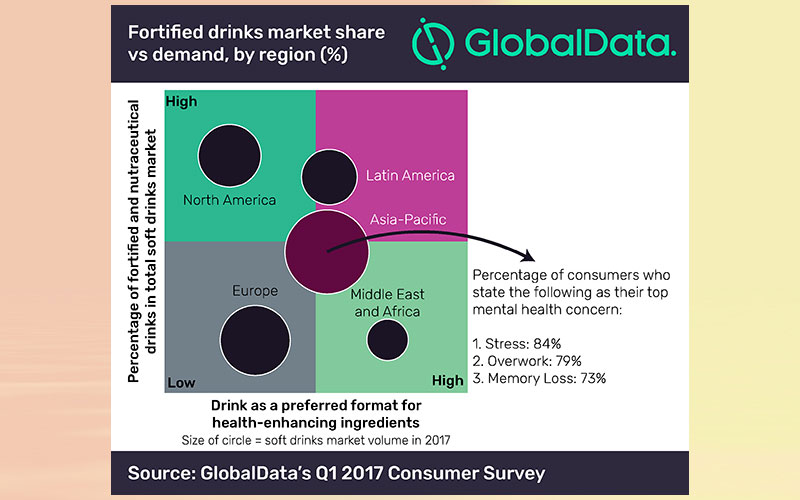

According to the company’s Q1 2017 consumer survey, stress, overwork and memory loss are the major concerns for APAC consumers. Among the three, stress was the leading mental health concern with 84 %.

The company’s report, ‘Top Trends in Healthcare and OTC Products 2018’ reveals that the majority (61 %) of consumers in APAC are looking for drinks with health-enhancing ingredients but very few drinks feature them.

Will Grimwade, Consumer Analyst at GlobalData, says: “Health drinks have often been pigeon holed into being either low sugar variants or energy boosters fortified with caffeine, vitamins or minerals. Mental health is a growing concern, but fortified drinks rarely address this need.

“Sales of fortified drinks and demand for drinks with health enhancing ingredients in APAC are both currently at a medium level. There is little focus on mental health within this sector and the large size of the total soft drinks market makes this a good opportunity.”

GlobalData expects a growing number of new launches to the market that include ingredients such as Gingko Biloba, Turmeric and Lecithin. Companies such as Coca-Cola are investing in emerging ingredients such as Cannabidiol (CBD) oil in North America due to its pain and anxiety easing effects, with use of the ingredient likely to spread to Asia within the next few years. This shows that companies are looking to target a more diverse range of health needs.

Grimwade concludes: “Economic growth is unlikely to stagnate and stress levels for APAC consumers are unlikely to drop, meaning the appeal of stress relieving drinks is likely to remain strong.”