Premium cider on the rise across European markets, says Canadean

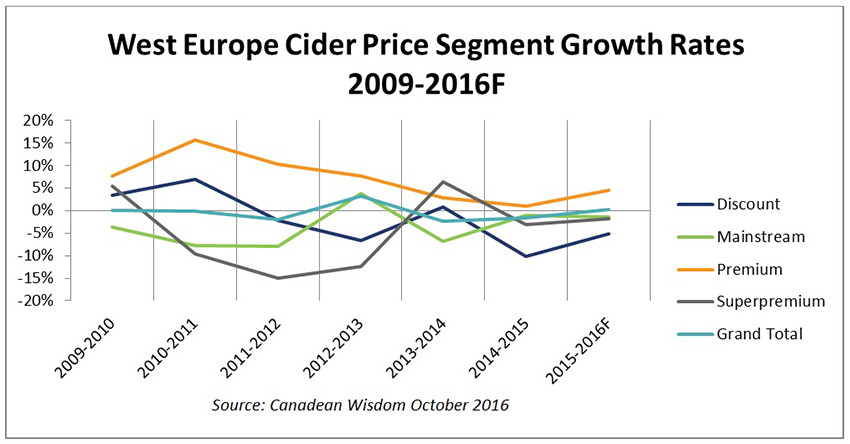

Premium cider brands in West Europe recorded a compound annual growth rate of almost 8 % between 2009 and 2015, far exceeding competing price segment categories which all posted declines, says consumer insight firm Canadean.

Premium cider brands in West Europe recorded a compound annual growth rate of almost 8 % between 2009 and 2015, far exceeding competing price segment categories which all posted declines, says consumer insight firm Canadean.

According to the company’s latest research, one of the most important trends currently being recorded in the West European cider market is the premiumization trend, which has led to consumers spending more on quality cider at the expense of discount and mainstream brands. Premium brands, determined as brands which have a price index between 115 %-149 %, when using the leading mainstream brand as the benchmark, have witnessed positive results from this. However superpremium brands, those priced in the market at a 150 % price index and above on the leading brand, have not yet benefited from this trend, with consumers still exhibiting some caution with their spending.

According to the company’s latest research, one of the most important trends currently being recorded in the West European cider market is the premiumization trend, which has led to consumers spending more on quality cider at the expense of discount and mainstream brands. Premium brands, determined as brands which have a price index between 115 %-149 %, when using the leading mainstream brand as the benchmark, have witnessed positive results from this. However superpremium brands, those priced in the market at a 150 % price index and above on the leading brand, have not yet benefited from this trend, with consumers still exhibiting some caution with their spending.

The impressive growth seen in West Europe was driven by strong performances in Spain (3 %) and France (15 %), as well as huge growth in the Republic of Ireland (107 %), helping to offset the 1 % decline in the largest market by volume, the United Kingdom.

Growth in Spain, the second largest premium cider market by volume, was a consequence of the increased demand for imported cider and ‘natural’ cider, which is generally associated with premium and superpremium price points. Natural cider in particular benefited from its popularity with young adult consumers, who find the concept of filtered cider with no added sugar to be appealing.

France’s market was largely in line with the rest of the continent, with volumes declining overall and premium offerings the sole growth point. Consumers in France are increasingly switching their cider drinking habits to quality over quantity, driving value growth.

The exceptional gains witnessed in the Republic of Ireland market for premium brands can be partly attributed to the recovering economy that has restored consumer confidence. Ireland was the fastest-growing economy in West Europe in 2015, and in a traditional cider drinking market, this proved fruitful for premium brands. Heineken also introduced its Orchard Thieves brand in 2015. After vigorous taste panel testing with Irish consumers, it has been designed specifically for the Irish palate, and entered the market with a high price point that more than doubled the volumes in the premium price segment.

Canadean states that premium cider will continue its consistent growth pattern in West Europe in 2016 due to rising consumer interest and willingness to purchase higher priced and quality ciders. Brewers quick to jump on this trend, as Heineken has been in the Republic of Ireland, could capitalize on this shift in consumer buying behavior by focusing on development of more unique and premium cider offerings.