Obesity rates driving sales of low calorie and low sugar soft drinks

The Mexican market is being driven by health concerns and government reforms have pushed the growth of low sugar, healthy goods as it was announced that Mexico had surpassed the US as the country with the highest child obesity rates in the world.

The Mexican market is being driven by health concerns and government reforms have pushed the growth of low sugar, healthy goods as it was announced that Mexico had surpassed the US as the country with the highest child obesity rates in the world. Among adults, in 2011, 70 % of Mexicans were overweight, with 30 % of these classed as obese compared to 68 % and 34 % of US citizens, respectively. This trend is predominantly in the rich, urban areas, with large numbers of children and adults in the poorer, rural regions still classed as underweight.

For adults, the problem seems to be longer working hours, which has led to an increase in ‘on-the-go’ consumption and a rise in the sales of fast foods. However, heightened awareness of the nutritional value of food and beverages has led to growth in the sales of packaged water and value-added drinks, such as drinking yogurt and nectars, which have supplementary calcium and anti-oxidant benefits.

In April 2011, the government declared that it would inform all Mexican children of the risks of obesity and has made this a public health issue, highlighting the seriousness of the situation. As part of this, the sale of any food or drink with an excess of 400 calories is now prohibited in schools. This has led many producers to develop drinks with low-sugar content. It has also resulted in an upsurge in the demand for ‘functional’ juice and nectars, with organic products seeing a rise in sales, despite the higher price, as they are generally viewed as healthier.

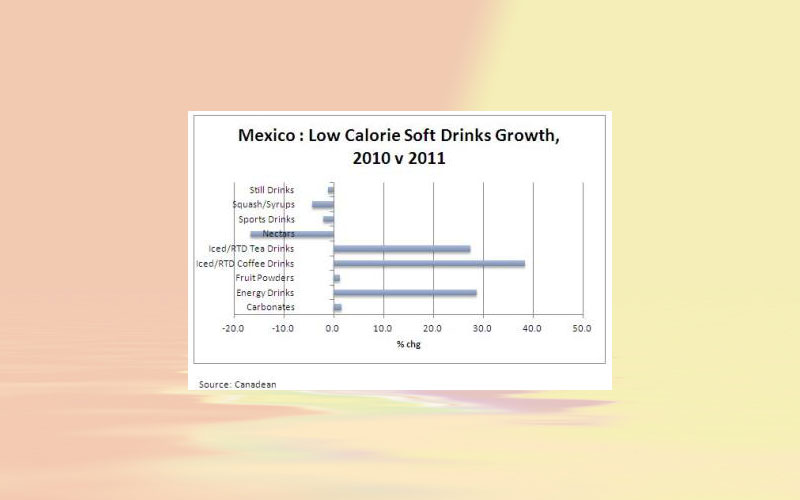

The rise in obesity has led to a rise in diabetes, further increasing the demand for low-sugar products. Despite this, low calorie variations of several soft drinks categories saw slow growth in 2011. Low-calorie carbonates grew by just over 1 %, compared to its regular counterpart, which experienced 5 % growth. Low-calorie nectars, however, saw a decline of around 17 % as it lost share to the still sweetened flavored water segment, with many producers introducing innovative new flavors.

In contrast to these negative trends, iced/rtd tea drinks saw exceptional growth throughout the year, as these products are increasingly seen as a healthy alternative to carbonates. Low calorie variants grew by around 26 %.

Additionally, regional juice producers have capitalized on the health trend by offering organic variants of soft drinks and marketing certain flavors as health drinks. Canadean expects the trend of low calorie and low sugar products to continue in 2012 and most soft drinks categories are forecast to see growth. However, this is expected to slow as the second wave of economic malaise affects businesses and consumers worldwide. Competition within the soft drinks market will remain rife, for example: juice versus nectars or carbonates versus iced/rtd tea drinks. The promotion of a healthier lifestyle will be the focus of marketing strategies and campaigns.

The information in this press release is from the report, “Mexico Soft Drinks Market Insights 2012”. More details about this report, please click here.