Coca-Cola launches new energy drink to tap Vietnamese market, says GlobalData

Coca-Cola has rolled out a new energy drink – Coca-Cola Energy – in Vietnam as part of the company’s larger focus to evolve into a complete beverage company and offer the Vietnamese consumers a wide range of drinks to cater the different lifestyles and occasions, says GlobalData, a leading data and analytics company.

Coca-Cola has rolled out a new energy drink – Coca-Cola Energy – in Vietnam as part of the company’s larger focus to evolve into a complete beverage company and offer the Vietnamese consumers a wide range of drinks to cater the different lifestyles and occasions, says GlobalData, a leading data and analytics company.

According to GlobalData’s 2018 Q4 Consumer Survey, around 41 % of Asia-Pacific (APAC) consumers prefer to experiment with new kind of soft drinks and around 40 % of them are willing to pay more for better quality soft drinks.

Shagun Sachdeva, Consumer Insights Analyst at GlobalData, says: “Soft drinks brands have been coming across increased competition amidst intensifying scrutiny of sugar-sweetened beverages and corresponding consumer efforts to make healthier choices. Against this backdrop, they are mapping out the wellness considerations for the products they are offering to attract a niche market of specialists such as sports enthusiast and athletes, whilst also appealing to the mainstream of active lifestylers.”

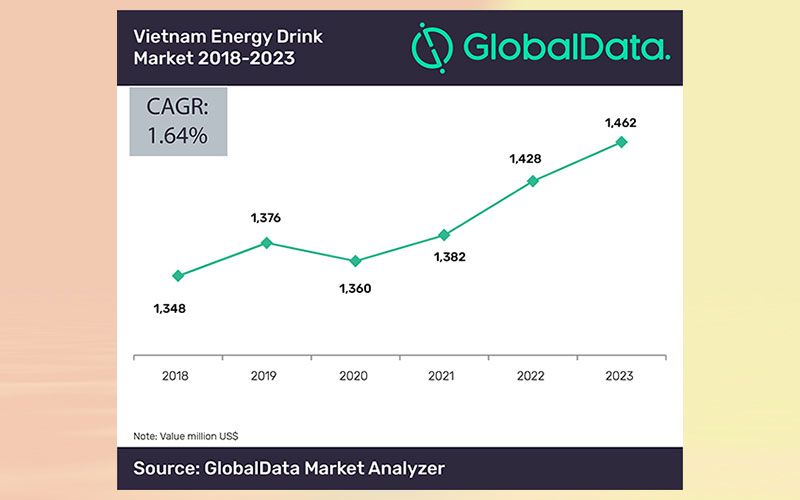

An analysis of GlobalData’s Market Analyzer reveals that APAC energy drinks market is expected to grow at a compound annual growth rate (CAGR) of 7.9 % from US$24.7bn in 2018 to US$36.2m in 2023. The Vietnamese energy drinks market is expected to reach US$1.46bn by 2023 from US$1.34bn in 2019.

Sachdeva adds: “Energy drinks have become a key thrust for Coca-Cola to rejuvenate growth in the APAC soft drinks market. The company is quick to understand that soft drinks category needs an image makeover. As a result, it is breaking the long-standing lead in Carbonated Soft Drinks (CSDs) by expanding its range of drinks portfolio to tap the correct set of active and time-scarce consumers and embracing innovation to sustain a highly competitive marketing profile.”

The other factors contributing to the emerging growth of the Vietnam energy drinks’ market are improving economic climate, socio-political stability and likelihood of stringent regulations as the Ministry of Finance has proposed a new sugar tax of 10% on sugary drinks from 2019.

Sachdeva concludes: “The launch comes at a time when most of the beverage companies are going beyond soda and there is growing competition in the carbonated market following the influx of countless other carbonated brands. Even though, Coca-Cola is already offering energy drinks under the brand name Monster, the company’s decision to launch energy drinks under its trademark will reinforce local identity, foster reassurance, create emotional resonance among the consumers and further deepen brand’s equity in Vietnam.”