Cott announced agreement to sell its traditional beverage manufacturing business to Refresco in all-cash transaction

Cott Corporation announced that it has entered into a definitive agreement to sell its traditional beverage manufacturing business (“Cott Beverages”) to Refresco for USD $1.25 billion.

Cott Corporation announced that it has entered into a definitive agreement to sell its traditional beverage manufacturing business (“Cott Beverages”) to Refresco for USD $1.25 billion. The transaction includes Cott’s North America, U.K., and Mexico businesses (excluding the RCI International division and its associated concentrate facility as well as the Aimia Foods division).

For over 60 years Cott Beverages has been a leading manufacturer of a diverse mix of beverages for the retail trade and branded manufacturers and is one of the world’s largest producers of beverages on behalf of retailers, brand owners and distributors, producing multiple types of beverages in a variety of packaging formats and sizes, including carbonated soft drinks, 100 % shelf stable juice and juice-based products, energy drinks, clear, still and sparkling flavored waters, sports drinks, new age beverages, ready-to-drink teas, freezables and ready-to-drink alcoholic beverages.

Cott Beverages generates approximately $1.7 billion in revenues and has a strong and experienced management team with longstanding customer relationships in North America and the United Kingdom. Subsequent to the closing of the transaction, Cott Beverages’ leadership team will report to the Executive Board of Refresco.

The transaction is expected to:

- Improve top-line growth and stability

- Enhance overall gross profit and EBITDA margins

- Significantly reduce net leverage

- Reduce customer concentration

- Reduce commodity exposure

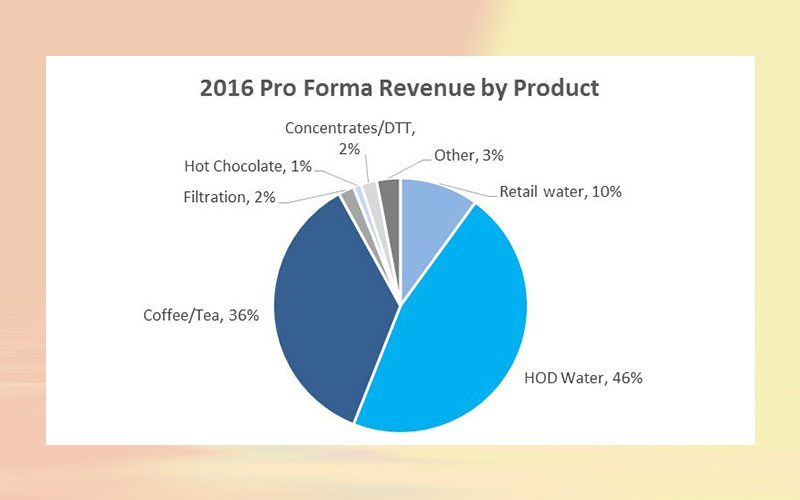

- Shift Cott’s core focus to the growing categories of water, coffee, tea and filtration

The acquisition, which is expected to close in the second half of 2017, is subject to certain closing conditions including regulatory approval, Refresco shareholder approval, and working capital adjustments.